It was almost like a unanimous decision when US billionaires sold stocks belonging to them and made billions of dollars in the space of a week.

The trend was so alarming that analysts suggested there might be an impending collapse in the financial market. So, if CEOs and majority shareholders are parting ways with their stocks, the question asks if small-time shareholders should be alarmed.

$8.5 Billion Worth of Stocks Change Hands in Less Than Two Weeks!

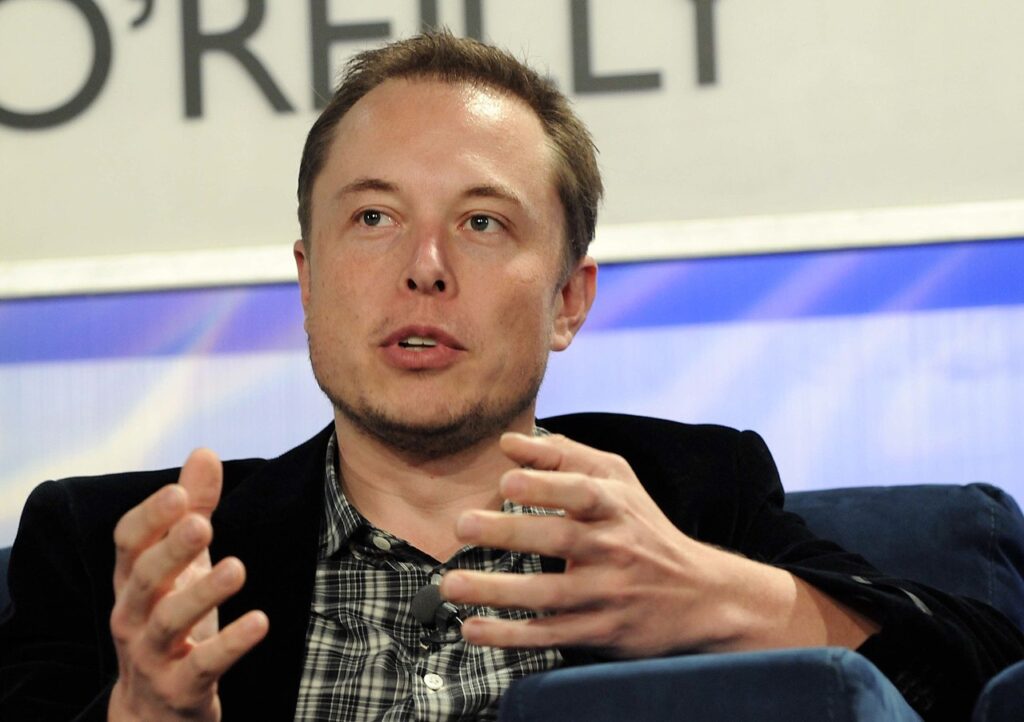

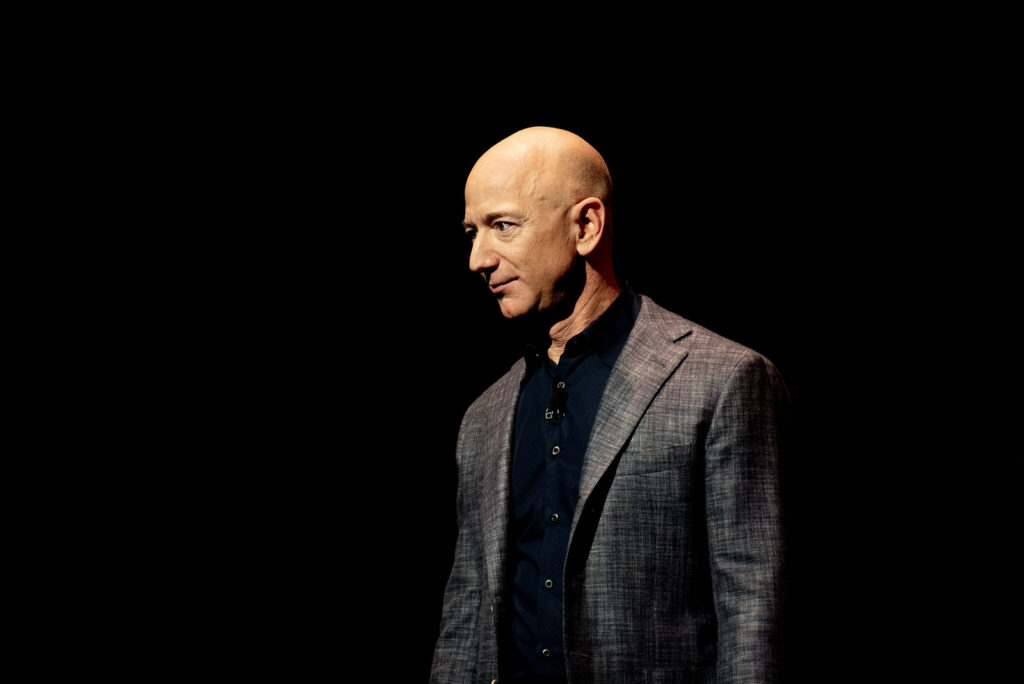

Elon Musk, Bernard Arnault, the prime mover of the MLVH, and Jeff Bezos all hold significant shares in Amazon, the e-commerce giant.

However, in March, the three billionaires sold part of their shares in Amazon and received a combined $8.5 billion in proceeds from the deals.

Tech CEOs and Financiers Cash Out Big

Likewise, Mark Zuckerberg, the fourth richest person in the world, put up some 1.4 million units of Meta shares. Zuckerberg made approximately $638 million from the fell swoop transaction.

Jamie Dimon has been CEO of JP Morgan for roughly 20 years. In March, for the first time in his chairmanship at the national financier, he sold $150 million worth of his stocks.

Even Those Who Have a Record of Holding Onto Shares Sold Some

The 34-year-old financial legacy of Leon Black of Apollo Global Management is to hold tightly to his stocks in his equity company.

However, he reviewed that strategy for the first time ever in March after selling $172.8 million worth of stocks for his equity company. Black is yet another major piece of that financial puzzle that points to something terminally amiss with the American financial market.

The Walton Family Were Not Left Out

The Walton family of the Walmart chain did not miss out on the big cash out. The family also sold $1.5 billion worth of stocks in the space of a week and some $0.8 billion worth of stocks in December.

Financial observers are trying to wrap their heads around the symphony with which these transactions occurred.

An Important Marker is the S&P 500 Index

The common theory among financial experts is that the looming elections are responsible for US billionaires’ seemingly panic sale of stocks. Financial analysts settled on this conclusion because the S&P 500 index is still quite high.

For the uninitiated, the S&P 500 index is a metric that measures the performance of stocks of the 500 largest companies in the US by valuation.

Finance Experts Look Into the Orb

During an interview with Fortune in February, finance consultant Alan Johnson affirmed that the stock market is looking up, and the political temperature of the United States is not bad.

However, Johnson suggests that the lump sum sale of stocks could be due to the “potential volatile fall” in response to the uncertainties building up as general elections edge closer.

Geopolitics and the Stock Market

The staffer at Johnson Associates then proceeds to make some projections on the geopolitical realities of American society. Despite the country’s amiable political terrain, Johnson admits its future lacks absolute predictability.

So, even billionaires cannot explicitly affirm what geopolitics in the US will become in a year or two from now. The general elections, coming up in November, will be the major determining factor.

Record High of S&P 500 Performance

Johnson also noted that the S&P 500 has performed exceptionally well in the past 12 months, rising by about 27 percent.

Naturally, the moneybags involved in the recent stock sales have made their financial portfolios even more liquid. So, rather than having their net worth perpetually tied up in stocks, these executives now have cash to expend on other transactions.

Invest, Don’t Tie Down Funds!

With the fresh liquidity of the executives’ financial portfolios, Johnson feels it is a plausible move from an investor’s perspective.

According to his argument, Johnson feels some of these CEOs are out to diversify their investments by expending the cash from stock sales as a driver for more profitable investments, say, as a stimulus fund for a profitable startup.

Milking Tax Breaks Dry

Of course, the actual motive of each Fortune 500 executive who sold their stock in March may vary. So, our financial expert is considering the stock sales from yet another perspective.

Johnson feels many of these executives are trying to exploit the tax breaks they currently enjoy to the best of their ability. Tax policies may change if a new administration occupies the Oval Office.

How the Elections Could Be a Disservice to CEOs

Many of the tax breaks presently enjoyed by companies and executives were initiated during Trump’s last administration, and there are predictions that a majority of Democrats winning in the coming elections could result in the total rescinding of all such benefits.

So, major financial players suggest that these executives’ moves to dump their stocks may be stoked by this fear.

They Know What Everybody Does Not

Similarly, financial analysts feel private information is likely passing through the billionaires’ grapevine to which the run-of-the-mill financial does not have access.

In a promotional video to sell their portfolio of metallic merchandise, American Hartford Gold suggested the trend of collective liquidations is a product of an impending economic recession that would soon unfold. But can we take their word for it?

American Hartford Gold Gifts the Public an Explainer

The Senior Director of American Hartford Gold, Mechi Block, in the video suggested that CEOs are using their broader perspective on the economy to preempt eventualities.

Block then proceeds to affirm that the execs are trying to avoid an incoming tech bubble before things get out of hand.

Economic Crisis in the Offing?

The American Hartford Gold video went public on February 29. Block was recorded saying, “Billionaire CEOs like [Jeff] Bezos, [Mark] Zuckerberg, Jamie Dimon, and the Walton family are selling off massive amounts of their own stocks, and analysts think the CEOS may be bracing for an economic downturn.”

While CEOs’ frenzied sales might seem normal, Block advises average Americans to be on the lookout.

A Video that Explains the Volume and Extent of the March Stock Transactions

In the promo video, Block also detailed the massive stock sales that took place in March. He listed each of the billionaires who sold stocks, the number of units sold, and for how much.

Block then proceeds to set forth an unproven theory that is quite similar to that of other financial experts like Johnson.

Sell During Peaks, Buy in Troughs

In his analysis, Block explained that these CEOs were primarily motivated to sell their stocks by the S&P 500 index’s all-time high performance.

According to Block, the exceptional performance is due to the profitability of seven top stock market companies. Meta, Amazon, and JP Morgan are examples of companies whose stock values have never been this high.

Turning Your Poker Chips to Cash

“Meta stock has soared 186 percent, JPMorgan is up nearly 30 percent, and Amazon has actually surged close to 90 percent. All three companies are trading close to record highs,” said Block.

However, like a person well-versed in the game of poker, these CEOs have decided to walk away by liquidating their record gains.

From the Peak, the Only Available Route is Down

Block suggests that these Fortune 500 CEOs are aware that the general elections will create uncertainties in the stock market, and it is unlikely that things will look up.

The shares of the top seven companies are already at an all-time high. So, financial uncertainties can only bring them down, not up.

Making the Best of the Season

“Selling implies that the shares are fully valued, and it is time to get out while the getting is good,” says Block.

Block, like Johnson, also suggests that the CEOs are probably trying to milk the tax breaks instituted by the Trump administration. The possibility is high that the new Congress coming in after the general elections will revoke such benefits.