In the past two years, a drove of ultra-rich people have found the United Arab Emirates (UAE) a place to enjoy their wealth. Interestingly, more of them may soon be moving to this Middle Eastern sanctuary.

According to the Henley Private Wealth Migration Report, the UAE will be emerging as the top destination of the world’s ultra-wealthy for the third year running.

The UK is Leaking Millionaires and Dripping on the UAE

Meanwhile, the United Kingdom is bound to become the top loser of its ultra-wealthy to the UAE. Estimates have it that a large proportion of expatriates who are settled in the UAE are from the UK.

The UBS, a Swiss bank, suggests that with the ongoing flight of wealthy people from the UK, the country would experience a 17% drop in its population of millionaires by 2028.

No More Effort To Support or Salvage Politics, Simply Bale When the Going Gets Tough

In recent years, wealthy people have become blithe about the political temperature of their locale. Once the conditions seem unfavorable, the ultra-rich simply seek some haven, particularly for their wealth, and move to places with lenient tax laws.

This explains why the UAE has become a magnet for rich people from around the world. For example, Dubai is tax-free for expatriates, and living there is like going on vacation.

Millionaires Anticipate Policy Changes from the New Administration

With the recent victory of the UK’s Labour Party in the just concluded June elections, even more high-net-worth individuals may seek refuge in other countries. Some financiers suggest this migratory trend is simply a manifestation of cause and effect.

Karim Jetha, an investor who relocated to the UAE from the UK during the pandemic, said, “There are push and pull factors for this trend of millionaires opting to relocate to Dubai.”

The Wealthy are Good at Reading the Room and Leaving When Necessary

The UK’s loss of millionaires to other countries is a typical example of how a nation’s politics can affect its economics.

Jetha suggests that “Push factors include the prospect of higher taxes under a new Labour government. For example, one of Labour’s campaign pledges was to levy VAT on private school tuition, which would raise the cost by 20%.”

Dubai Is a Top Relocation Destination for the World’s Wealthy

In addition, the UAE is atop the choice list of millionaires leaving the UK partly because of “Dubai’s perception of being extremely safe and visa reforms that encourage migration,” says Jetha.

Thanks to its visionary policies, the UAE is set to experience an influx of some 6,700 millionaires from different parts of the world by the end of 2024. According to the Henley report, the US comes in second on the list of wealth magnets and anticipates the arrival of 3,800 millionaires within the same period.

Money Can Buy the Keys to the City

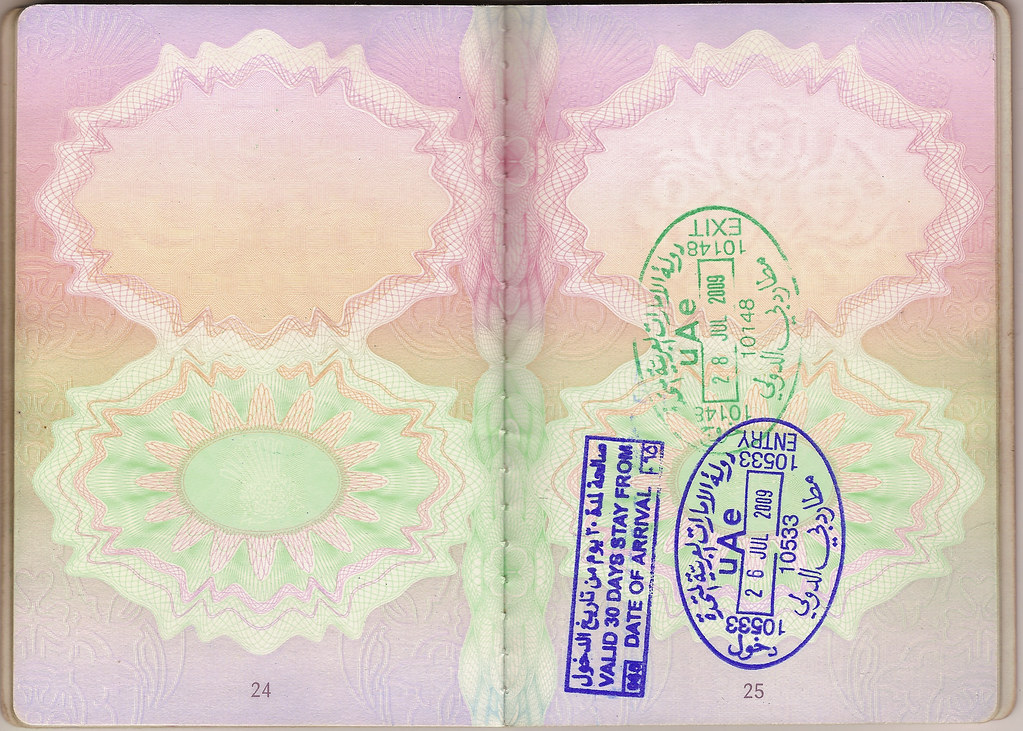

Foreigners with a thick wallet can easily obtain the UAE’s golden visa, which allows them to live long-term, study, or work in the country. In addition, the Henley report reads, “With its zero income tax, golden visas, luxury lifestyle, and strategic location, the UAE has entrenched itself as the world’s number one destination for migrating millionaires.”

The report also affirms that the UAE is already home to expats from Africa, Russia, and other Middle Eastern countries. However, a large number of Brits should join the bus soon.

How Intentional and Progressive Policies Can Change the Progress of a Nation

The UAE policies that made the country the top choice for wealthy people worldwide are barely five years old. Nonetheless, it has had a far-reaching effect on the quality of migrants entering the country. There’s no denying that such a monumental achievement may take some other country 30 years to achieve.

The UAE refers to these developmental reforms as the “wealth management ecosystem.” As it stands, hiding funds away in Swiss banks may soon go out of fashion.

The Name of the Game is ‘Protect and Compound Your Hard-Earned Wealth’

According to Sunita Singh-Dalal, a partner at the Hourani Private Wealth & Family Offices in Dubai, “In less than five years, the UAE has introduced a robust regulatory framework that provides the wealthy with a range of innovative solutions to protect, preserve and enhance their wealth.”

In addition, regions of the UAE like Dubai offer eye-popping perks, like investment incentives, remote worker visas for digital nomads, zero income tax, low crime, geographical hub, robust infrastructure, and educational systems.

Pay Taxes Through Your Nose or Invest Your Income in a Thriving Economy

Naturally, anyone who can afford the benefits that the UAE offers would gladly opt for it. In the face of minimal collateral damage, migrating millionaires may be a far better choice than funding social systems in their home countries through heavy taxation and operational charges.

So, the UBS Wealth Report projects that the UK will “see its millionaire population drop from 3,061,553 last year to 2,542,464 by 2028.”

ALSO READ: 25 Budget-Friendly Girls’ Trip Ideas For Your Next Getaway

The UK Kisses “Non-Dom” Goodbye

The UK’s proposed 2025 reversion of its “non-dom” status, which exempts wealthy residents from tax remission on overseas income, is partly responsible for the impending millionaire exodus.

Unfortunately, things may get even more complicated for the UK. According to Hannah White, a director at the Institute for Government in London, “The outflow already generated by the economic and political turmoil in Britain risks being accelerated by further unwelcome policy decisions.”

Education May Stop Being the UK’s Greatest Export

White points out some UK policies that seem to drive the wealthy out of the country. She spotlights the 40% duty on estates exceeding the 325,000 euros ($417,755) benchmark.

White added, “Labour’s commitment to remove their exemption from 20% VAT is a further unwelcome development.” It would make education relatively more expensive in the UK.

You Might Also Like:

Cathie Wood Offloads $25 Million Worth of Underperforming Tech Stock

McDonald’s Might Have to Leave California