The Amazon pricing strategy that is in force today came about thanks to a chance insight. Jeff Bezos set up a meeting with Jim Sinegal, founder of Costco, to discuss a wholesale supplier deal. However, Amazon’s founder walked away from that casual meeting with a business insight worth billions of dollars.

Thanks to that ‘Costco advice,’ Amazon will become a $2 trillion value-driven business after 30 years.

Amazon’s Rocky Beginnings

After seven years of existence, Amazon faced an uncertain future in 2001. The financial crisis following the Dot-com bubble made even Bezos unsure of the company’s survival. Many early investors abandoned the ship, anticipating Amazon’s imminent demise. As a result, stock prices crashed by 90 percent.

However, like a mother who never gives up on their ailing child, Bezos kept on the struggle to revive Amazon. Interestingly, a pivotal piece of advice that helped Bezos and Amazon out of the ditch came from the founder of a supposed rival retail company, Costco. Jim Sinegal, founder and former CEO of Costco, was lavish with the advice that gave Bezos a boost in managing Amazon’s precarious situation.

ALSO READ: Amazon Lures Back Erstwhile Customers With 30% Discount on Groceries

A Crucial Meeting with Costco’s Founder

Jeff Bezos had an entirely different intent when he arranged to meet with Sinegal in 2001. As part of his brainstorming effort on how to steer Amazon through the storm, Bezos was considering partnering with Costco. The goal was to make Costco a wholesale supplier of some products.

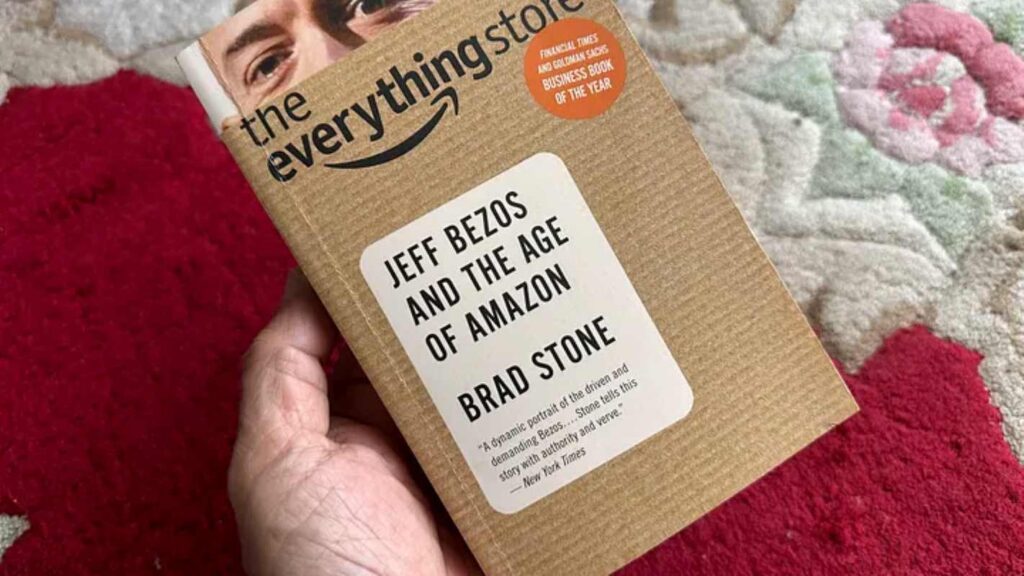

The meeting was held at a coffee shop inside a Barnes & Noble near Amazon’s offices in Bellevue, Washington. Details of this meeting are contained in Brad Stone’s 2013 book The Everything Store. Bezos wanted to discuss a potential partnership between the two retail companies, Amazon and Costco. However, Sinegal took time to explain the dynamic pricing, value proposition, and promotional discounts that make Costco an authority in the retail industry.

During the 2001 meeting, Sinegal explained how Costco could offer customers lower prices than other retailers. According to Stone’s account, Sinegal mentioned that Costco took on the cost leadership reins by maintaining a healthy relationship with suppliers and getting attractive deals for competitive analysis.

So, Costco does not need much competitive analysis because dynamic pricing, value proposition, and promotional discounts keep buyers coming, and so far, there’s market demand. This method of attracting new customers and retaining old ones is called the loss leader strategy. Essentially, despite sometimes operating at a loss through price matching and the cost leadership strategy, CostCo still manages to break even from annual memberships and similar subscription services.

Amazon’s Pivot to Lower Prices

A few days after Bezos met with Sinegal, he asked to meet with Amazon’s executives. Guess what the focus of that meeting was? If Amazon’s pricing strategy came to mind, you’re spot on. Bezos harped to the executives about the need to jettison Amazon’s ‘incoherent’ pricing.

After Bezos met with his executives, Amazon also rolled out the loss leader strategy and price matching. Since then, Amazon has strived to offer lower prices than its competitors.

The Impact of Strategic Price Cuts

It did not take long for the impact of the price cuts to start materializing. In the summer of 2001, Amazon began to offer heavy discounts, as high as 30%, on all its flagship products. By Q4 2021, the then-unprofitable Amazon had its first green in the earnings report.

In interviews with The New York Times, Bezos attributed the sudden turnaround to the lower prices that come with the loss leader strategy. He also added that Amazon has become ingenious at eliminating unnecessary costs to make discounts feasible.

In 2002, when the news of Amazon’s rebound went viral, Bezos told a Fox News reporter, “We had a great Q4. We’re incredibly proud of it. And what really drove it was lower prices for customers…”

The Birth of Amazon Prime

Fast forward to 2005, Amazon unveiled the incorporation of subscription services with a membership program called Amazon Prime. This program allows members to enjoy discounts and free shipping on orders with an upfront fee. Amazon naturally started mopping up the market demand for products in stock, and Amazon Prime further enabled customer segmentation.

In a 2016 shareholder newsletter, Jeff Bezos used words that recalled his conversation with Sinegal in 2001. The portion in focus reads, “We want Prime to be such a good value, you’d be irresponsible not to be a member.”

ALSO READ: 17-Year-Old Student Turns $10,000 Prize Into Amazon Side Hustle Generating $71,000 Monthly

The Legacy of the Meeting

To date, there is no public acknowledgment or official statement in which Bezos mentions his 2001 meeting with Sinegal as the eureka moment for the transformational Amazon pricing strategy.

Even Amazon’s efforts at customer segmentation to drive profit are quite similar to those operated by Costco. In a late 2001 report, The Times also compared Amazon’s pricing strategy to that of Costco.