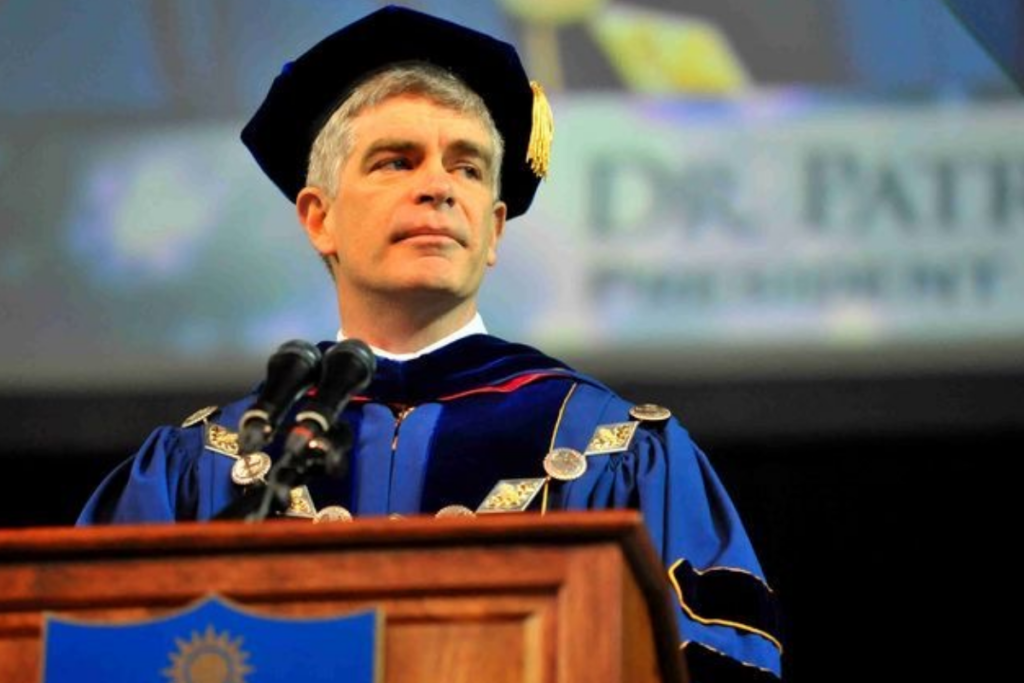

Philadelphia Federal Reserve President Patrick Harker revealed that the Federal Reserve may reduce the federal interest rate in September. Harker made this statement in an interview during the Federal Reserve’s annual retreat in Jackson Hole, Wyoming. According to his direct statement, the Federal Reserve will soon make it easier for people and businesses to borrow money.

When Will the Next Fed Meeting Occur?

In Harker’s words, monetary policy easing is almost inevitable, and the decision is expected to be made when officials have another meeting in less than a month. The Chairman of the US Federal Reserve, Jerome Powell, also made a statement on this. Powell declared, “The time has come for the US Federal Reserve to cut its interest rates.”

The Federal Reserve is considering lowering interest rates because it is more confident about current inflation. The Fed is sure about where inflation is going and wants to prevent possible weaknesses in the labor market.

ALSO READ: Predicted Fed Interest Cuts May Make Traveling Abroad More Expensive for Americans

The decision on the federal interest rate cut should be made in September. However, the exact rate is yet to be known. Harker believes that when the rate is ready to be cut, it should be done methodically. Harker made a statement during a “Squawk on the Street” interview.

He said, “I believe we need to start pushing interest rates down this September.”

Harker also believes the Fed should carefully execute its plan and inform the people beforehand.

What Is the Fed September Interest Rate?

Harker said that regarding the rate in September, markets are 100% certain that there will be a 25% cut and a 25% chance of a 50 basis point reduction. However, the Philadelphia Federal Reserve President doesn’t want to decide yet.

He said, “I am not supporting or deciding between a 25- or 50-basis-point cut. I need to see more weeks of data before making my decision.”

What Is the Current Federal Interest Rate?

In an effort to deal with ongoing inflation, the Federal Reserve has kept federal interest rates between 5.25% and 5.5% since July 2024. After the July Fed meeting, when the Fed did not see enough reason to start reducing federal interest rates, there was a brief pushback from the markets.

However, the Fed has had enough reason and evidence to reduce borrowing rates since then. The Philadelphia Federal Reserve president, Patrick Harker, said the policy will be made independently of political concerns, especially as the presidential election is approaching.

“At the Fed, we are proud technocrats. That is our job, and I am very proud of being there,” Harker said. “Our job involves looking at the data and giving suitable responses. When I look at the data as a proud technocrat, it’s time to start decreasing rates.”

Although Harker cannot vote on interest rate decisions this year, he can still share his thoughts during meetings. Another member of the Fed who cannot vote is Kansas City Federal Reserve President Jefferey Schmid. Schmid also shared his opinions during an interview on Thursday. Although he didn’t give a clear view of what might happen with interest rates, he still said interest rates would be reduced soon.

ALSO READ: High-Interest Rates Could Benefit Americans Planning to Retire

Economic Indicators for Federal Interest Rate

Schmid mentioned that the increase in the unemployment rate is a clear indicator of what is happening. Before, there were more workers than jobs available, which increased wages. The increase in wages added to the increasing inflation. However, fewer available jobs have recently been created, and unemployment has risen steadily.

According to Schmid, how the labor market is cooling down is helpful. However, there’s still more that needs to be done. “I believe we need to take a closer look at how the unemployment rate went from 3.5% to where it is now. It is a little over 4% today.

However, Schmid said he believes the banks have performed well despite high interest rates and that the present monetary policy is not “overly restrictive.”

The Chairman of the US Federal Reserve, Jerome Powell, also gave another indicator. He said price growth is now on a sustainable path back to normal. This is a significant signal that the Fed (Central Bank) will start reducing interest rates next month.

What Happens When Federal Interest Rates Are Cut?

Based on what policymakers are expecting, a small rate cut of 0.25 or 0.50 percentage points might slightly reduce people’s borrowing costs, according to Ted Rossman, a senior industry analyst at Bankrate. The rate cut would also affect mortgage rates, which might keep going down, especially if inflation keeps falling and the labor market shrinks.

Rossman further explained that, from a consumer’s perspective, lower federal interest rates will occur slowly. They won’t happen as fast as the sudden rate increase between 2022 and 2023 when the Fed raised rates by 5.25 percentage points. Rossman added that although mortgage rates are declining, there has been no significant reduction in credit card or auto loan rates.

You Might Also Like:

Cathie Wood Makes Major Investments in This Hot AI Stock—And It May Surprise You

Boeing Halts 777X Aircraft Tests After Discovering Damage to Jet Structure

Alaska Airlines and Hawaiian Airlines Merger Passes Justice Department Review, Awaits DOT Approval

Mars to Acquire Kellanova in $36 Billion Snack Industry Deal