Using a spreadsheet or a notepad to track your investments can be challenging, especially if you have an extensive investment portfolio with various brokerages and assets ranging from stocks and bonds to real estate and mutual funds. So, rather than do it the hard way, why not use an app to track your investments?

With the help of modern technology, you can keep track of everything. In this guide, we’ll explore the top 10 apps for tracking investments that can simplify portfolio management and help investors at all levels stay on top of their portfolios.

This list covers the best apps for tracking investment portfolios, their various features, and their benefits, from portfolio monitoring to investment analysis.

1. Yahoo! Finance

The Yahoo Finance app is a popular financial information platform with a simple-to-use design, so you can easily track your stocks, commodities, bonds, ETFs, and currencies. Using this app, you can create and track the performance of your portfolio and sync multiple portfolios across all your devices. In addition to the free option, there are three tiers of this platform:

- Bronze: For monitoring investment accounts, 401(k) plans, and individual retirement accounts (IRAs).

- Silver: For simple investment features like insider trading and dividend analysis.

- Gold: For services related to active trading, like alerts, technical event screeners, and advanced charting.

The platform offers real-time investing data and a wide range of tools depending on the tier you buy, but it doesn’t permit trading in the app or connecting bank accounts, so it may be challenging to get a full overview of your finances.

Pros:

- Yahoo Finance offers four platform tiers for investors with different goals.

- It provides real-time investing data and includes breaking news coverage.

- The app provides free portfolio tracking with up-to-date data on stocks and other assets.

- It is perfect for monitoring the S&P 500 with global market updates and trends.

- It is very accessible, with a user-friendly website and mobile app.

Cons:

- Yahoo Finance has limited options for customizing a portfolio compared to other apps.

- The free version includes ads, which can be distracting sometimes.

- The 3-tier-paid version costs between $7.95 and $39.95 monthly, above the free tier.

- It doesn’t let you connect your bank accounts.

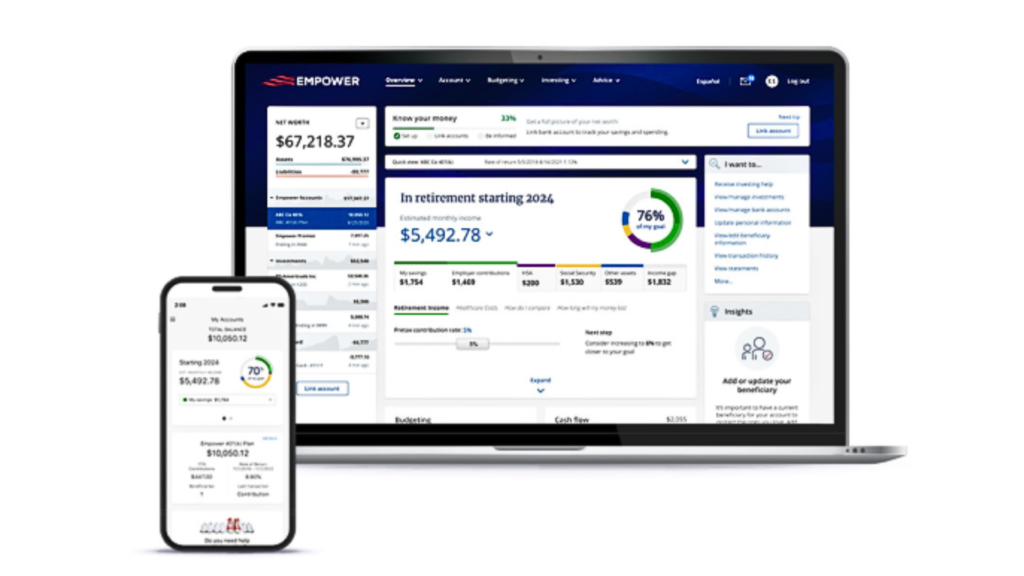

2. Empower

Empower (formerly Personal Capital) is among the best apps for tracking your investments. It combines investment tracking with retirement planning and is completely free.

Its Financial Dashboard shows all your accounts in one place and allows you to add your credit cards, savings, loans, investments, checking accounts, savings accounts, and more to one place. Additionally, it makes it easy for you to track your investment performance, spending patterns, and net worth.

Pros:

- Empower has a wide range of money management tools, like retirement planning.

- It combines financial tracking with personalized recommendations for portfolio improvement.

- Free portfolio tracker features are available.

Cons:

- The free version offers limited features.

- Users must sign up for premium services to access advanced analytics.

- Investment services require a minimum account balance of $100,000.

ALSO READ: Top 10 Best Investments Opportunities for 2024

3. Finary

Finary is an all-in-one investment management app that can be used to manage your budget and cash flow, analyze your portfolio’s risk levels, measure your level of diversification, find hidden investment costs, and even manage the finances of your whole family.

Finary also allows you to link accounts for stocks, funds, and savings, as well as real estate, cryptocurrency, crowdlending, and more. Unlike most other investment trackers, you can also trade crypto on the app. However, the help center and educational resources are in French because Finary is owned by a French company.

Pros:

- Finary allows users to invest in crypto directly on the app.

- It connects to 20,000 banks, brokers, and crypto exchanges worldwide.

- There is a free version.

Cons:

- Subscription service can be expensive.

- The educational content and help center are in French.

4. Fidelity

Fidelity is one of the best free portfolio trackers available if you’re a new investor needing a brokerage. It is a must-have app as it provides a smooth process to manage your investment and retirement accounts from your phone.

Although it’s not quite a portfolio tracker, you can open retirement and individual accounts with ease and invest in stocks, bonds, ETFs, or options on the platform. You can manually link non-fidelity accounts, set savings goals, add investment strategies, and more. It has a decent mobile app with net worth and retirement planning features.

Pros:

- The Fidelity app integrates all Fidelity accounts for easy portfolio tracking.

- It provides access to Fidelity’s research tools, financial insights, and stock tracker.

- There are no additional costs for Fidelity users.

Cons:

- There is limited access for people without a Fidelity account.

- The platform may appear to be overly detailed for beginners.

5. Ziggma

Ziggma is an investment platform that tracks your positions and allows you to simulate how new positions will impact your portfolio. By inputting a hypothetical trade, you can see how your portfolio’s diversification, Beta, and several other KPIs are affected. This platform is designed to help you quickly analyze your portfolio and make data-driven investment decisions.

Ziggma can be accessed using any web browser, but it doesn’t have a dedicated mobile app or allow users to directly trade on the platform. It is believed to be used mainly through active traders and long-term investors who want to check their portfolio quality, yield, risk, and climate impact all in one place.

Pros:

- Ziggma provides frequent updates on investment performance.

- The platform offers free screening and alert tools.

- Comprehensive stock research.

- Users can use a portfolio simulator to test investment strategies before committing.

- The platform strongly emphasizes diversification and provides insights into asset allocation.

Cons:

- Ziggma has no mobile app.

- Some advanced features require a subscription.

- Limited integrations with certain brokerage accounts.

6. M1 Finance

M1 Finance offers a unique approach to investing, combining the best of self-directed investing. It is built around dollar-cost averaging, which is regularly investing the same amount of money in a security or portfolio regardless of price. The app uses “Pies” as a visual tool to organize assets by type. Plus, you can rebalance your pie or invest according to your targets with one click.

Pros:

- M1 Finance offers a free portfolio tracker and investment management for a customized asset class.

- It is excellent for long-term investments, with automated contribution options available.

- It has a user-friendly mobile app interface.

Cons:

- It has limited features for analyzing individual stocks.

- It is not the best option for day traders or those seeking extensive real-time tracking.

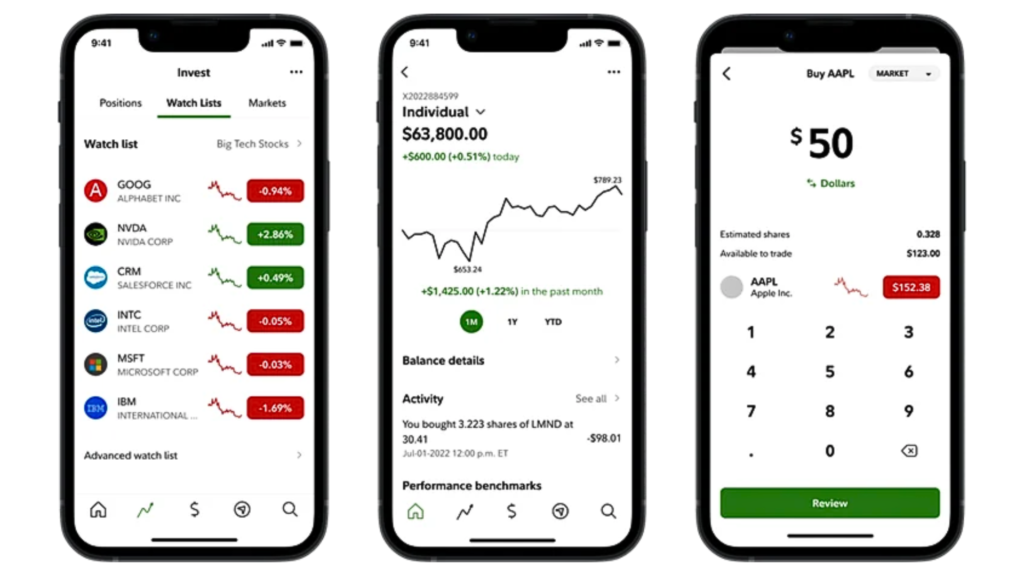

7. Seeking Alpha

Seeking Alpha is one of the best investment research platforms out there. It is an excellent choice for investors who prefer in-depth analysis and insights on stocks, making it an excellent stock tracker app. It is the most accessible platform for linking your brokerage accounts.

Seeking Alpha also provides information on investment research. In less than five minutes, you can receive portfolio tips based on Quant ratings, Wall Street analysis, and Seeking Alpha authors’ sentiment.

Pros:

- Seeking Alpha provides access to financial news and stock research in real-time.

- It provides a “Quant Rating” system to help investors make informed decisions.

- It has a strong community of investors sharing insights.

Cons:

- Users need a premium subscription for advanced analytics and content.

- Some users may find the platform overwhelming because the platform offers so much information.

8. Quicken Simplifi

Simplifi was recently added to Quicken’s lineup of money management tools.

When you connect investment accounts—like IRAs, 401(k)s, and brokerage accounts—to Simplifi, you get a full view of all your investment balances across all linked accounts. You also get a detailed overview of holdings across your accounts and a news feed for every stock you own.

Additionally, Simplifi serves as a budgeting tool, as it can accommodate whatever type of budgeting strategy you like. Its simple interface makes saving for short—and long-term goals easier. The platform also sends out real-time alerts to track when your bills are paid or when you get large deposits.

Pros:

- Simple and easy to use for beginning investors.

- Users get real-time alerts.

- It offers guidance for personal finance and investments.

- It tracks spending and savings goals.

- Serves as a budgeting tool.

Cons:

- Simplifi requires a paid monthly subscription.

- There is a need to upgrade the tax strategy.

9. Delta

Delta is a portfolio-tracking app that allows you to track a wide range of investments all in one place: cryptocurrencies, non-fungible tokens (NFTs), stocks, currencies, bonds, mutual funds, ETFs, options, and futures.

For this reason, it may be one of the best options for investors who make various asset investments. The platform offers detailed analysis of investments and tools like price alerts to help you make well-informed buy and sell decisions.

Pros:

- It automatically syncs with 10,000 brokers, wallets, exchanges, and banks.

- It has a free version.

- It offers price alerts in real-time.

Cons:

- The app does not allow trading.

- No tracking of real estate.

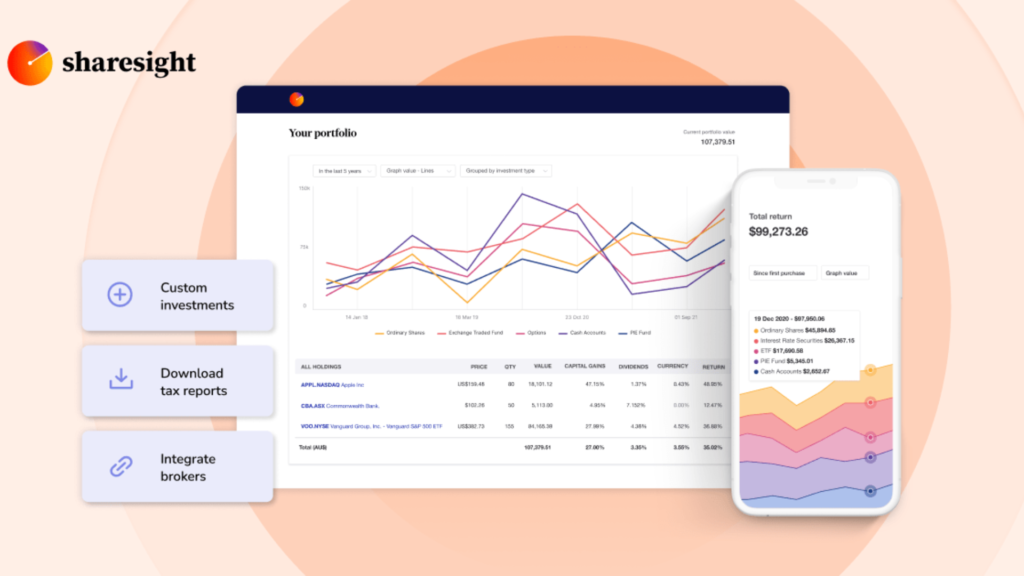

10. Sharesight

Sharesight is an all-in-one portfolio tracker and tax-reporting tool that tracks your performance, dividends, and diversification across 50 international exchanges. International investors highly value it for monitoring stocks and capital gains across multiple asset classes.

Sharesight also automatically integrates with more than 200 international brokers. The platform lets you add your cash accounts and property holdings to get a complete view of your financial progress.

Pros:

- Sharesight offers excellent tracking of dividends, which can be automatically reinvested.

- It is a great free portfolio tracker that allows users to track performance across various global exchanges.

- It offers access to insightful tax reporting tools.

Cons:

- The free version of this app is limited to tracking only ten stocks.

- Subscription is required for advanced features.

ALSO READ: 5 Best Investments That Hedge Against Inflation

What Are Investment Portfolio Management Apps?

Investment portfolio management apps are desktop programs or mobile apps that efficiently track and manage stocks, bonds, options, mutual funds, real estate currencies, futures, and other assets in your investment portfolio.

They serve as portfolio trackers, providing an overview of financial performance and helping users make informed investment decisions. These apps help investors keep track of asset classes such as stocks, bonds, and real estate, allowing them to manage investments all in one place.

Criteria for Selecting the Best Portfolio Trackers

Choosing the best apps for tracking investments largely depends on individual investment goals, asset types, and the level of tracking needed. The following are factors to consider when evaluating investing products and services:

- Usability: It should have a user-friendly interface with efficient features that is easy to navigate.

- Available Offers: Confirm whether there is a special offer or discount for signing up on the platform.

- Compatibility: The best apps for tracking investments should be able to link bank accounts, credit cards, and major brokerage accounts.

- Price: Many of the best free portfolio tracker apps offer incredible features, but for access to advanced features, find out the cost of monthly premium subscriptions and any hidden fees.

- Security: Look for apps with secure login options and protection against data breaches.

Essential Features of a Portfolio Management App

An effective portfolio management app should offer these key features:

- Tracking and Planning Features: Apps should typically offer reporting functions, asset allocation, research capabilities, and portfolio tracking tools.

- Real-Time Data: Regular updates on asset value, stock portfolio changes, and market trends.

- Performance Dashboard: Every portfolio management app should have a dashboard to see your total portfolio and performance at a glance.

- Customization: The app should have options to set alerts, organize by asset class, and set financial goals.

- Analysis Tools: Tools to help you analyze your portfolio performance are critical for making sound investment decisions.

- Integration: Apps should be able to link with bank accounts, brokerage accounts, and retirement accounts for full supervision.

Finding the correct portfolio tracking apps depends on factors like the assets you manage, your investment experience, and your financial goals. But with the help of these tools, you can confidently manage your assets since you have access to accurate and up-to-date information about your investment performance.

Finally, specific tracking tools can be integrated with mobile payment apps, simplifying the experience for business owners who make various investments.