Student debt is quite common in the United States, as many adults spend most of their adult years trying to pay off the loans they used to attend their respective schools. A new survey has shown that many states have high student loan debt numbers while some have shallow ones.

States like Mississippi and Delaware have high debt numbers, while others like Utah and Hawaii are deficient.

A New Survey on Student Loan Debt

According to a new survey by WalletHub, some states in the United States have more student loan debt than others. The personal finance company conducted this survey using many metrics, giving each state a score of 100 and showing the proportion of student debt.

The Education Data Initiative research group also stated earlier this year that the average federal student borrows $32,362 to get a bachelor’s degree.

What State Has the Highest Student Debt?

According to the WalletHub survey, Mississippi has the highest student debt burden, with a 66.2 score out of 100 points. The state’s average debt is about 58% of the median income, making it the highest in the country.

The students do not have a loan ombudsman to complain about their loan burdens, and it also has the third-highest default rate on student debt in the U.S.

Pennsylvania

Coming in as a close second is Pennsylvania. According to WalletHub, the debtors in this state owe 46% of its median income. Its score out of 100 was 61.25, and the state does not have a loan ombudsman, just like Mississippi. In addition, it has the third-highest average student debt in the country at over $39,000.

The survey’s results also show that about 64% of students in Pennsylvania have significant loan debts, which makes it the fourth in the country in that category.

ALSO READ: Student Loan Forgiveness: Woman Cries Over Father’s Response

Delaware

Delaware is third on this list, following Pennsylvania with a score of 60.85 out of 100. The survey showed that the state’s student debt is about 43% of the median income.

Like the two highest states, Delaware does not have an ombudsman to which debtors can complain about their loans. About 60% of its residents who attended higher education schools have student loans that aren’t to be paid.

The Top Ten National Student Loan Debt States

West Virginia and South Carolina are the fourth and fifth states that the survey found to have the highest student loan debts. Unlike the three aforementioned states, these two have an ombudsman to whom they can complain about their student loan debt burden.

The sixth and seventh states are New Hampshire and South Dakota, respectively. The remaining three are none other than New Jersey, Ohio, and Kentucky, in that order.

Lowest Student Loan Debt States

While the survey sought to determine which states have the highest student debt in the country, it also found which states do not have a high debt burden.

These states ranked at the bottom of the list of the highest student loan debt in the country. However, they can be considered the top five states with the lowest student debt in the U.S.: Hawaii, Washington, Utah, New Mexico, and California, in no particular order.

Biden’s Debt Relief Programs

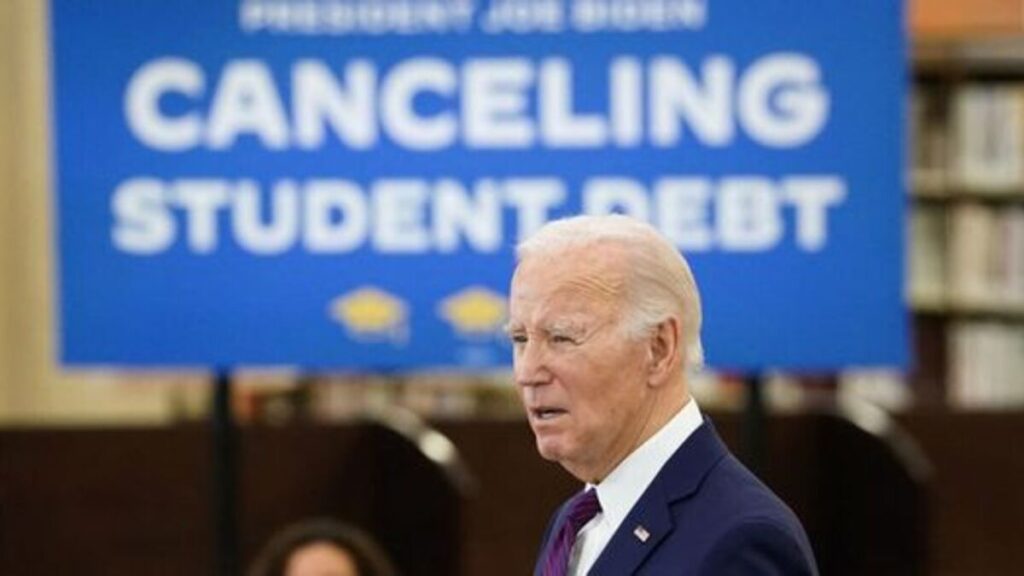

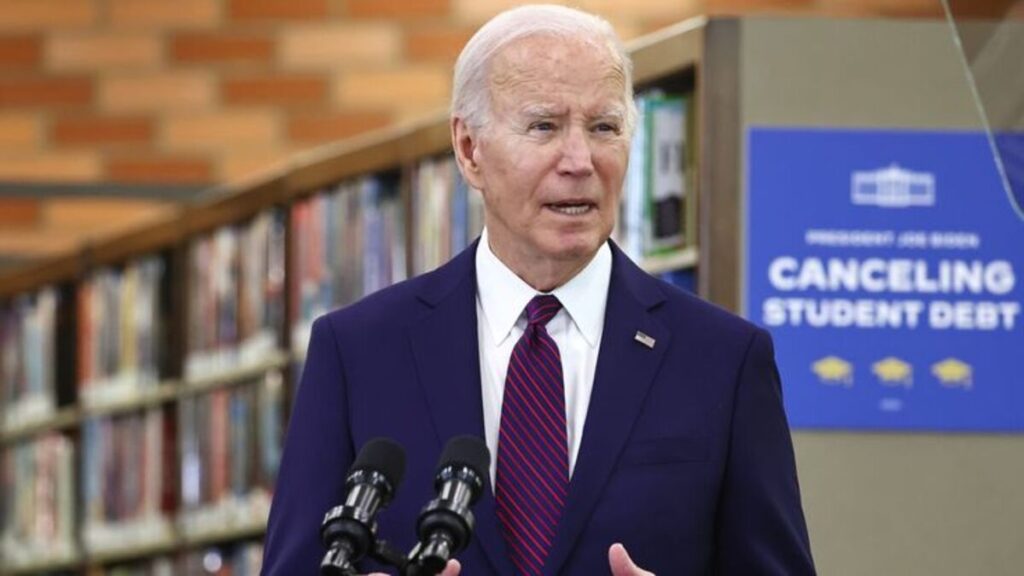

Many people can agree that the Biden-Harris administration has been very particular about helping people with student debts. During its tenure, the administration introduced several debt relief programs, hoping to help thousands of debtors across the country.

However, experts still believe that the federal government and state officials can do much more to help those struggling with education debts. Some people spend decades trying to pay back their student loans, affecting their quality of life.

Better Funding

According to experts, the federal government and state agencies can do a lot more for debtors while in power. Meg Hancock, an associate professor at the University of Louisville, told Newsweek, “Rather than reduce the amount of money students can borrow, federal and state governments would do well to better fund educational institutions, particularly state universities, historically Black colleges and universities, and tribal colleges.”

Therefore, this will benefit all people and communities, making education more accessible.

Opposition to the Debt Relief Programs

The current administration has had a record number of debt relief programs since 2020. However, the administration has also been criticized heavily for these programs. Sometimes, Republican lawmakers purposely block the administration from approving programs to help with debt relief.

According to the White House, the Biden-Harris administration has still been able to approve $146 billion to help with student debt relief for about four million Americans despite many obstacles.

ALSO READ: U.S. Toy Company, Basic Fun!, Goes Bankrupt with $50M Debt

Which Students Have the Most Debt?

According to reports from the Education Data Initiative, African American or Black student borrowers have the highest debt in the U.S. Data shows that the African American demographic owes $25,000 more than the White demographic for those with bachelor degrees.

The data goes further to show that even four years after graduation, 48% of Black student borrowers are still owing more than they borrowed initially, compared to White student borrowers at 17%.

What Percentage of Students Pay Back Their Loans?

The Education Data Initiative also reports that 20% of all American adults with undergraduate degrees have outstanding student debt. For postgraduate degree holders, the percentage is 24%, reporting that they have outstanding student debt.

With a 5-year annual average student loan debt increase rate of 15%, about 20% of adults in the United States report that they have completely paid off their student debt. Adults take an average of 20 years to pay off their student loan debts.

Who Suffers the Most From Student Debt?

Many people do not know that women suffer more from student loan debts than their male counterparts. A number of reasons could cause this, but the most obvious is the low income they receive.

Women are typically paid about 80% of what men in the same positions earn, which causes them to earn less than men. With lower pay and the income gap, women are unable to repay their debts as fast as men can.

You Might Also Like:

These Silicon Valley Billionaires, Founders, and Investors Are Rallying Behind Kamala Harris

This Expert Tip Is the Best Way To Cut Your Wedding Guest List

Here’s What the Failed Expanded Child Tax Credit Means for Families in the US

A Shuttered Power Plant in Michigan Could Pave the Way for More Nuclear Energy in the U.S.