One of the foremost financial goals most people aim at is having a good credit score. It is not something people stumble upon, nor does it rub off on them. Instead, individuals can build a good one by being intentional with their finances, expenses, and credit usage.

There are a handful of credit score systems for assessing the risk of lending money to individuals. However, its assessments by entities like VantageScore and Fair Isaac Corporation (FICO) are the most prolific. Both FICO and VantageScore rate individuals’ cumulative debt risk on a scale of 300 to 850. It can be improved over time; the higher it gets, the better.

What Is a Good Credit Score?

The perfect FICO credit score is 850, while 300 is judged poor. According to FICO, only 1.6% of the American population has a credit score of 850. This is understandable because it can be a very difficult feat to achieve. However, FICO suggests that a credit score between 670 and 739 is a good one. Individuals don’t necessarily need a perfect 850, 800, or above; all folks need to get a FICO rubber stamp of “excellent credit score.”

Individuals should always strive to keep their FICO credit score above 579. Anything below that figure is deemed a poor score. Credit scores between 580 and 669 and 740 and 799 are deemed fair and very good, respectively.

However, despite operating on a similar scale as FICO, VantageScore 4.0 has a different range for good credit scores. It takes a score of between 661 and 780 to be qualified by VantageScore. Also, unlike FICO, ScoreVantage rules credit scores lower than 600 as poor.

ALSO READ: Average Credit Card Debt Climbs to $6,329: ‘People Are Stretched,’ Expert Warns

How To Get a Good Credit Score

Navigators often sought to establish their coordinates in exploration before proceeding to their next destination. Similarly, it is essential to understand one’s credit status before aiming to make good or excellent. So, to know their current credit score, an individual can follow one of three routes.

You can get yours by approaching the credit bureaus or FICO. Credit bureaus grant one free request per year, while subsequent requests come at a fee. Some lenders provide customers with their credit scores for free. Find out if yours offers this fringe benefit.

Next, establish the following advice to improve your credit score over time.

- Limit credit enquiries: Individuals want to avoid applying for every loan offer or new credit card package that lenders make available. Why not, you ask? A better question is: “What is a good credit score for a credit card?” Each time people apply for a credit facility, their report is subject to a “hard inquiry.” Each of those inquiries dents credit scores a bit. Now, imagine having a handful of it. So, do some personal research before applying for any credit instead of hopping from one to another.

- Pay bills on time: Paying bills before the due date greatly helps credit scores. Now, it’s one thing to pay on time and another to pay in full, but never excuse yourself from defaulting on the two. Missing payments leave a big and conspicuous chasm on credit reports.

- Endeavour to maintain old credit accounts: Even if you are not using that old credit account at the moment, maintain it nonetheless. The longer it stays, the brighter it shines. It improves credit utilisation assessment and drives up your credit score.

- Keep card balances low: Credit experts recommend keeping credit utilisation below 30%. Doing this should help grow credit scores significantly.

Key Factors That Impact Your Credit Score

As individuals embark on their credit adoption journey, it is essential to consider factors that may help them build credit scores. Individuals may need to set more lofty goals than the ranges here attributed to FICO and VantageScore. However, it is equally important to understand the factors that will help drive the scores as high as possible.

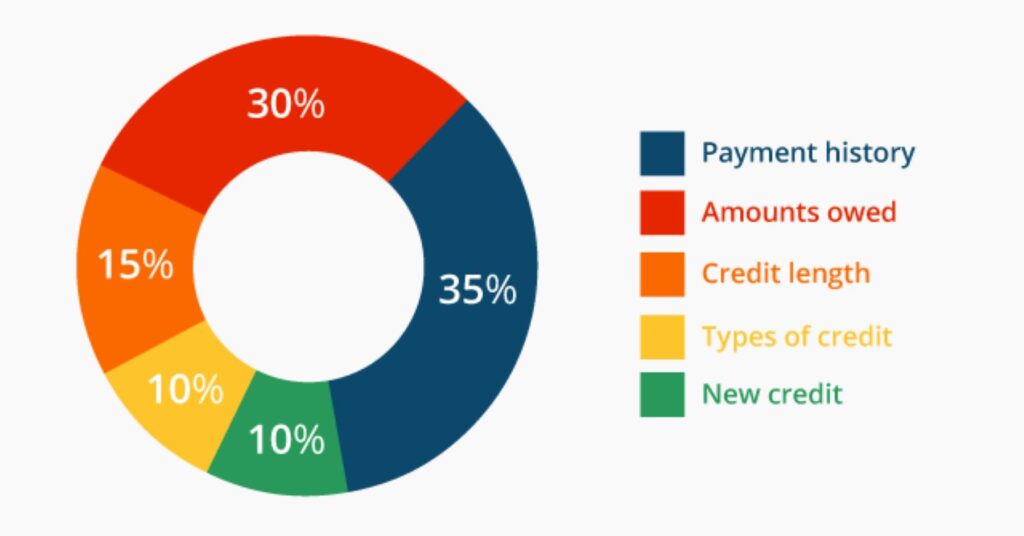

FICO calculates credit scores by assigning percentages to some five credit factors highlighted below:

- Credit mix: During a hard inquiry, lenders want to be sure that an individual’s credit history is not monotonous. For example, when applying for a loan to pay your rent, asking yourself: “What is a good credit score for renting?” won’t cut it. This means lenders are more likely to approve credit applications of people with a history of performing well on different credit variants.

- New credit: Having several new credit applications on your credit flag is often a red flag to lenders. It gives the individual off as desperate and very likely to default.

- Length of credit history: The longer an individual has maintained a credit account, the better their FICO score. This factor makes up 15%.

- Debt Balance: Borrowers want to keep the amount owed on their credit accounts as low as possible. Never exploit all your available credit, just a portion of it. This factor contributes 30% to a FICO score.

- Repayment history: A repayment history that indicates that a borrower settles their loans on time boosts their FICO score. This factor covers 35% of the score.

ALSO READ: Why Parents Should Consider Locking Their Child’s Credit Early On

What Is a Good Starting Credit Score?

What is the benefit of having a good credit score? For folks with no credit history, having a 300 FICO credit score is perfectly okay. However, lenders would frown on an individual with a credit history and a poor credit score. More often than not, it takes a good credit score to get credit applications approved.

You Might Also Like:

Your Guide on How To Buy Gold Bars

Steps To Opening a Roth IRA for Kids

Checking vs. Savings Accounts: Key Differences Explained

IRS Audits Focuses on Wealthy Americans: Key Red Flags for Everyday Filers

Huawei’s Trifold Phone Secures 2.7 Million Pre-Orders Ahead of iPhone 16 Launch