Financial forecasts and investment analysis by digital currency analysts strongly speculate that Bitcoin price 2025 will be 200 percent of its 2024 price. So, this piece will analyze the potential economic factors that may drive up the price of Bitcoins in 2025. Let us get right to it.

Main Factors Influencing Bitcoin’s Price

Bitcoins seldom have a consistent price like any other digital asset or capital-intensive investment. Likewise, no one variable solely dictates the trajectory of such digital currencies. So, we shall be breaking down nine likely factors influencing Bitcoin price 2025.

ALSO READ: Bitcoin Hits New Milestone, As It Was Recently Valued At $72,000

1. Bitcoin Ecosystem Growth and Increased Use Cases

Bitcoin investors no longer limit their activities on digital currency trends to hedging of liquid wealth. One of the notable attributes of Bitcoin over the years is its ability to outpace national inflation. However, with the emergence of new use cases for Bitcoin, its value will appreciate some more.

Some of Bitcoin’s prominent new uses are non-fungible tokens (NFTs) and decentralized finance (DeFi). Also, some loan lenders now accept it as collateral because of its global recognition in digital currency trends.

Bitcoin enthusiasts are still engineering new use cases, thereby growing the currency’s ecosystem. If this trend continues, which we are sure it will, Bitcoin’s value will inevitably increase.

2. Public Perception and Media Coverage

Emerging digital currencies often run multiple promotions right after their launch as part of their trading strategies. Some run airdrop campaigns and offer free coins for the number of times users share about the new coin on social media. The bottom line of such campaigns is publicity, which is used to get more people to join these digital currency trends. The adoption of a currency is usually impossible without widespread awareness.

Our point? In contrast to new and emerging digital currencies, Bitcoin does not pull publicity stunts, run peer-to-peer campaigns, or convince people with investment analysis. Indeed, Bitcoin has become an established brand, so much so that mainstream media repeatedly covers it. Likewise, many public figures are equally endorsing it.

So, people no longer slur Bitcoin as a currency for expediting terrorism and money laundering. Instead, the reputation of this digital asset has been greatly enhanced in the past few years, driving up its price.

3. Influence of Emerging Markets

The relative stability of economies in the global West makes them sluggish and conservative in their adoption of Bitcoin and other popular cryptocurrencies. In contrast, regions of the world rife with economic instabilities are gladly embracing Bitcoin as a store of value.

Many of the countries experiencing widespread adoption are those who need alternatives to their established but exploitative financial systems. Similarly, some of these regions even lack seamless access to traditional banking facilities, say due to political instabilities. Such trends are common in Asia, Latin America, and Africa.

Nonetheless, Bitcoin adoption in these emerging markets is still slow. However, that trend is unlikely to continue forever. As more people in these spotlight regions adopt Bitcoin in 2025, the price will rise even more.

4. Demand and Supply Dynamics

The dollar is one of the strongest currencies in the world, partly because of the resilience of the US economy and its international demand. In many parts of the world, the US dollar is accepted as the standard mode of exchange for international transactions.

Presently, Bitcoin has a fixed supply of about 21 million units. Yes, Bitcoin mining efforts are ongoing. However, the demand for this currency will probably remain high. The gist is many people don’t see Bitcoin as a medium of exchange but as a digital asset for keeps. In mugglespeak, most people see Bitcoin as a long-term investment and seldom let it go right after coming into possession.

So, from the preceding, it is easy to realize that the high demand and short supply of Bitcoin will keep driving up its price.

5. Regulatory Clarity and Global Acceptance of Bitcoin

Countries guard their economic integrity jealously and crack down on unregulated entities and commodities in a bid to retain control and predictability. Regulations have been a double whammy for Bitcoin’s potential. For example, most countries don’t have spelled-out regulations on cryptocurrencies like Bitcoin. Consequently, uncertainties about the poise of local authorities in such domains drive the volatility of Bitcoin’s price.

For example, El Salvador recently initiated fiscal policies that make Bitcoin acceptable in the country for financial transactions. If and when the leading economies of the world initiate similar explicit regulations on the adoption of Bitcoin, institutions and e-commerce retailers would equally warm up to the cryptocurrency.

As 2025 comes around the next bend and with impending geopolitical changes, countries may start rolling out pro-Bitcoin regulations.

6. Mining Networks and Technology Boosts Cryptocurrency Value

Bitcoin, like any other currency, comes with its fair share of challenges. For example, since its launch in 2009, developers and enthusiasts have pointed out how slow transaction speeds can get. In addition, transaction fees can be pretty high. Despite having secure and decentralized blockchain technology, it was largely impracticable for everyday transactions.

However, that bottleneck is about to give way with the recent emergence of Layer 2 solutions. Layer 2 solutions are technological innovations that enable faster and cheaper Bitcoin transactions. An example is the Lightning Network, which enables cheaper and faster Bitcoin transactions.

Here’s how it works. The Lightning Network allows users to conduct off-chain transactions without waiting to settle or balance them through the coin’s blockchain technology. It works more like the escrow organizations run by central banks to allow seamless transactions across local commercial banks.

7. Economic Factors Driving Fiscal Policies that Support and Adopt Bitcoin

As we mentioned earlier, Bitcoin tends to be less responsive to the rising inflation relative to conventional currencies. Naturally, as central banks around the world initiate fiscal policies in response to rising inflation, the currencies tend to lose value. Meanwhile, cryptocurrency value is often left unfazed.

So, investors who are aware of market predictions and money valuation don’t leave their money sitting in banks. Instead, they use Bitcoin as a hedge against inflation. Consequently, with inflation not showing signs of assuaging, investors are likely to demand Bitcoin as a store of liquid assets in the future.

8. Growing Institutional Adoption of Bitcoin

It may interest you to know that not just individuals invest in Bitcoin. Notable organizations have backed this digital asset by holding tangible sums on their balance sheets.

Examples of institutions that have adopted Bitcoin and further boosted its credibility are MicroStrategy, Tesla, hedge funds, and some major financial institutions. Interestingly, Tesla went as far as accepting Bitcoins as payment for Tesla autos some years back.

In addition, you no longer have to be extremely wealthy to invest in Bitcoin. There are Bitcoin ETFs (Exchange-Traded Funds) now available for small-time investors. Hedge fund and derivatives experts, however, suggest that these new trading strategies of Bitcoin have the potential to drive up the price.

ALSO READ: Morgan Stanley’s Wealth Advisors Can Now Pitch Bitcoin ETFs

9. Historical Precedence of Bitcoin Value Spikes

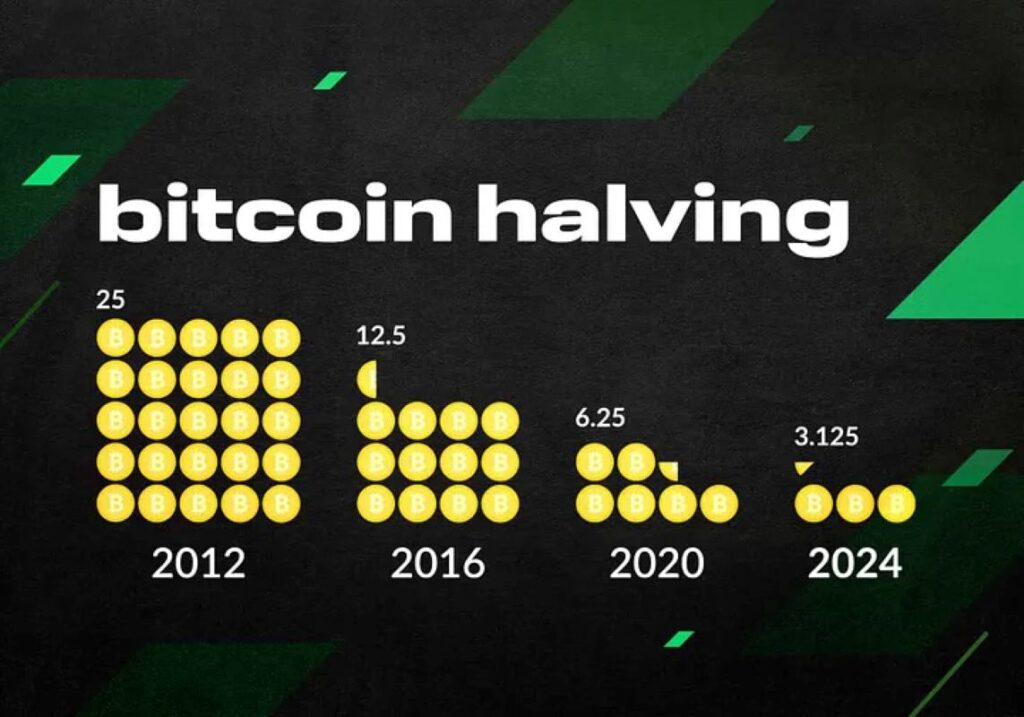

Anyone familiar with financial market predictions and history must have noticed that recessions seem to follow a trend or cycle. Similarly, cryptocurrency analysts have observed that the price of Bitcoin seems to follow a four-year cycle. This four-year cycle of Bitcoin valuation has been ascribed to the halving events that follow the same trend.

Bitcoin halving entails reducing the rewards for mining a new block of the currency. This event, which happens every four years, raises the rate at which new Bitcoins are mined. If the supply of Bitcoin surges uncontrollably, the value will naturally crash.

For an illustration of how Bitcoin halving may cause a price boom in 2025, let’s take a quick look at the last two halvings. After the Bitcoin halving of 2016, the price of Bitcoin went through the roof in 2017. Similarly, after the next halving in 2020, there was a phenomenal increase in Bitcoin price. The next halving is expected to take place in 2024 and we can anticipate an even higher valuation for Bitcoin in 2025.

Exact Bitcoin price predictions and financial forecasts are seldom spot on. However, the probability that it will indeed increase is very high. All the odds are stacked in favor of an increase. So, let’s look forward to what becomes of Bitcoin’s price in 2025.