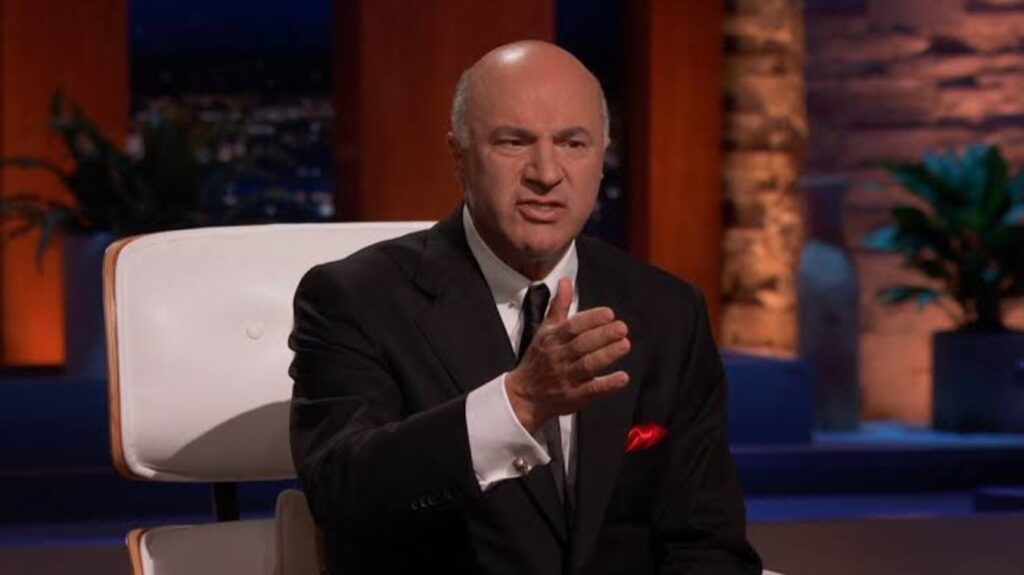

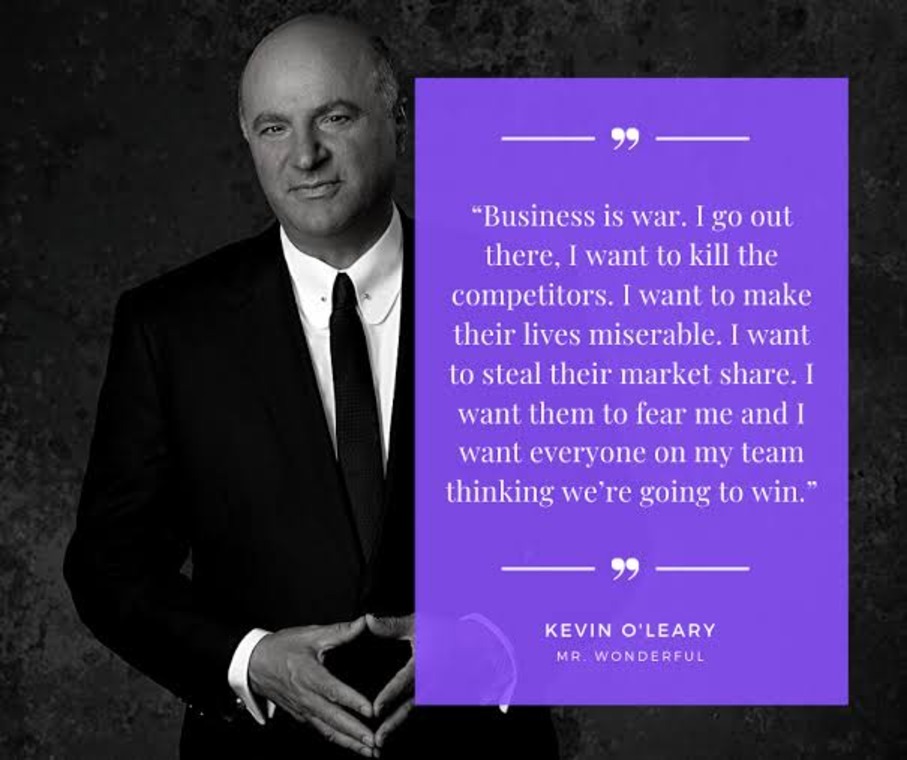

Kevin O’Leary went as far as explaining that making the first million is usually a tug of war. He then added that right after surmounting that hurdle, building generational wealth then becomes easy.

Interestingly, according to a publication by Moneywise, this opinion is not peculiar to O’Leary alone. Several other millionaires in the US explain that their first million was the most difficult.

Moneywise Schools Budding Investors

According to Moneywise, the late Charlie Munger once said that his first $100,000 was the most difficult milestone for him to attain. As of the time of his passing, Munger had amassed a mammoth wealth of $2.5 billion.

It should be safe to also take O’Leary’s words for it, as he is acclaimed to be worth an estimated $400 million. So, these wealth investors are preparing the minds of potential millionaires for the need to overcome an ‘escape velocity.’

Compound Interest is the Key!

Moneywise’s explanation of this trend, of having to attain a certain money threshold before wealth creation becomes easy, is simply compounding. According to the financial advisory company, the effect of compound interest is most prominent when you have a sizeable sum of money to start with.

So, you naturally find it easier to build wealth when there is something to compound than starting from nothing at all.

Build a Trampoline With Your Start-Up Capital and Leap

The takeaway from Kevin O’Leary’s YouTube video is that investors just starting up should take time to build a robust financial springboard. So, building the startup cash is usually difficult because it comes with a lot of sacrifice.

Often, the investor would have to put all their expendable money into the business. Likewise, the more they put back their profit into the business, the faster it grows.

The Musk Playbook

When the Musk brothers started their first business, Zip2, in 1995, the duo lived out of their one-room office. Kimbal and Elon Musk would often go to a nearby YMCA to shower. The Musks later sold Zip2 for $307 million in 1999.

While no one recommends living like a homeless person when building a business, it indicates how much sacrifice comes with building wealth from scratch.

Cash May Not Be Required to Start, but It’s Needed to Grow Fast

So, accumulating wealth to serve as a bastion for a startup should be the first on an investor’s priority list. By implication, besides saving as much as possible, an investor just starting should steer clear of high-risk investments.

Losing the little money you have scrapped together can be quite frustrating and could make an investor throw in the towel altogether. So, investors, avoid losses as much as you can.

Get Rid of That Itch!

In O’Leary’s video, he tried explaining the grand investment recommendations from scratch. First off, an investor needs to build financial resilience and discipline.

When an investor sees money flowing in, it can be challenging to stop themself from buying things they have always craved or some new fad. Financial discipline is an important muscle that an investor needs to build.

A Safe Place to Build Steady Wealth

Kevin O’Leary’s second advice is to invest in the stock market and bring in a steady return of roughly 8%. According to him, investors can break the one million threshold by putting their first stream of profits into low-risk stocks.

From there, the investor can set a new target. O’Leary mentioned that his next target after hitting his first million was $5 million.

There Are Levels of Wealth That Mere Motivation Cannot Sustain

To gun for $50 million, Kevin O’Leary said the investor has to be super enthusiastic about what they are doing. For example, the Musk brothers are self-taught in programming and took advantage of this skill in their businesses, so much so that Tesla is fast becoming a software company, selling software upgrades for their electric vehicles.

Another example is Richard Branson; a bulk of the billionaire’s wealth was built around things he is passionate about.

The O’Leary Credentials

O’Leary is a veteran in the business of building wealth. He started his first company, Softkey Products, in 1986 and sold it for $4.2 billion in 1999. He would later found many other companies like O’Leary Ventures and O’Leary Fine Wines.

Kevin O’Leary made an exciting revelation of how he perceives his money. He said, “I think of my money: as soldiers. I send them out to war every day. I want them to take prisoners and come home, so there’s more of them.”