If you’ve been looking for ways to grow your savings, you might want to consider using a certificate of Deposit (CD). A CD is a financial tool that allows you to deposit a certain amount of money over a set period and earn interest at a fixed rate until the term ends.

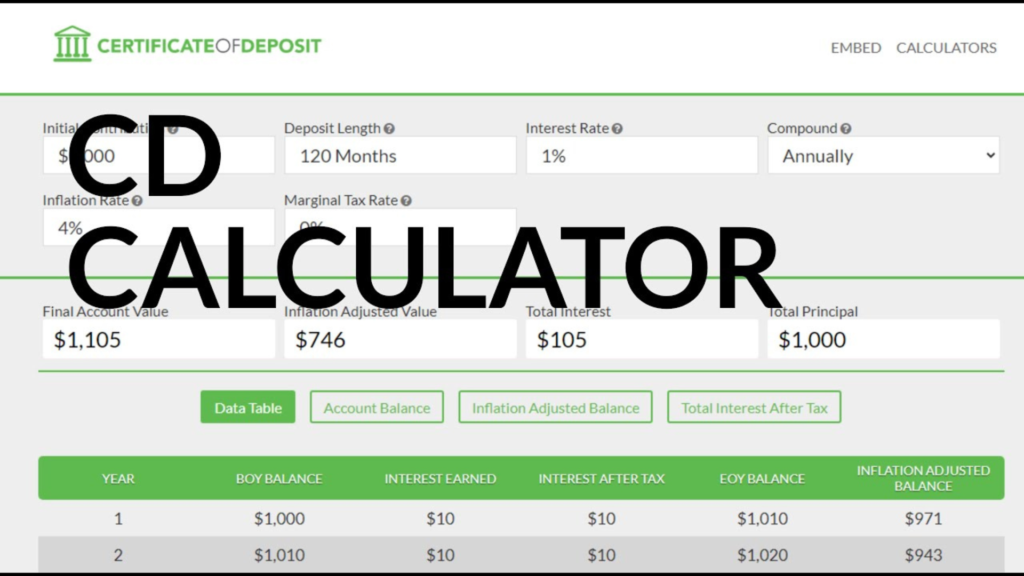

However, it can sometimes be challenging to determine precisely how much you’ll earn from a CD. However, with a Certificate of Deposit calculator, you can estimate your potential returns based on inputs like the deposit amount, interest rate, and period duration.

A Certificate of Deposit calculator can guide you in making informed decisions and maximizing your earnings.

What Is a Certificate of Deposit?

A Certificate of Deposit is a “time deposit” savings option offered by banks and credit unions. It is a low-risk savings option offered by banks and credit unions. It allows you to deposit a large sum of money for a set period, which could be a few months to several years.

In return, the bank or credit union will pay you a fixed interest rate, usually higher than what you’d receive in a traditional savings account. CDs are a popular choice for people looking to grow their savings without exposure to market volatility because they offer safe and predictable returns.

Here’s how it works:

When you open a CD, you agree not to take out your money for the specified period, which could be six months, one year, five years, or more. In exchange, the financial institution pays you interest based on the agreed rate. You get your original deposit back at the end of the term, plus the interest you earned.

ALSO READ: Top 10 Best Investments Opportunities for 2024

How to Use a Certificate of Deposit (CD) Calculator

A Certificate of Deposit calculator is a tool that helps you estimate how much interest you’ll get from your CD investment. It factors in the following:

- Initial deposit: the amount of money you plan to deposit.

- Interest rate: This is the annual percentage yield or APY you’ll be paid.

- Term: These are the months or years you’ll need to keep your money in the CD.

After that, the calculator shows the total interest you will earn and the total amount you will get at the end of the term.

Now, to use a CD calculator, follow these steps:

- Enter the Initial Deposit Amount: Enter the money you plan to invest in the CD. This is your principal balance.

- Enter the Interest Rate (APY): The Certificate of Deposit calculator APY (Annual Percentage Yield) is the annual rate of return that accounts for compound interest. So, use the correct rate for the CD you’re considering.

- Select the CD term: Choose the duration of the CD, whether it’s a short-term 6-month CD or a longer-term option of 5 years. Note that longer terms often offer higher interest rates but lock up your money for a more extended period.

- Choose the Compounding Frequency: Interest can be compounded daily, monthly, or annually. The more frequently it’s compounded, the more money you’ll make. A CD compound interest calculator can help you see how different compounding frequencies affect your returns.

- Calculate: Click the calculate button, and the tool will show you your estimated interest earnings and the total balance at maturity.

Using a CD calculator can help you compare different options easily and choose the CD that best fits your financial goals.

Reasons to Use a Certificate of Deposit (CD) Calculator

There are many advantages to using a certificate of deposit calculator, especially when comparing different CD options or planning for long-term savings. Here’s why you should consider using one:

- Accurate Earnings Projections: A CD calculator generates accurate estimates of your potential earnings based on your data. This gives you a clear picture of how much your money will increase over time.

- Comparison of Different CDs: If you’re trying to choose between different CDs with different interest rates and terms, a calculator allows you to compare them side-by-side to see which offers the highest return.

- Planning for Future Financial Goals: Whether you’re saving for retirement, an emergency fund, or a trip, using a CD calculator can help you plan for the future by showing how much your money will grow over a specific period.

- Understanding the Impact of Compounding: A calculator lets you see how daily, monthly, or annual compounding affects your final balance.

- Risk-Free Projections: Unlike other investment tools, a CD calculator provides a reliable prediction without the unpredictability of stock markets or other high-risk investments.

ALSO READ: Checking vs. Savings Accounts: Key Differences Explained

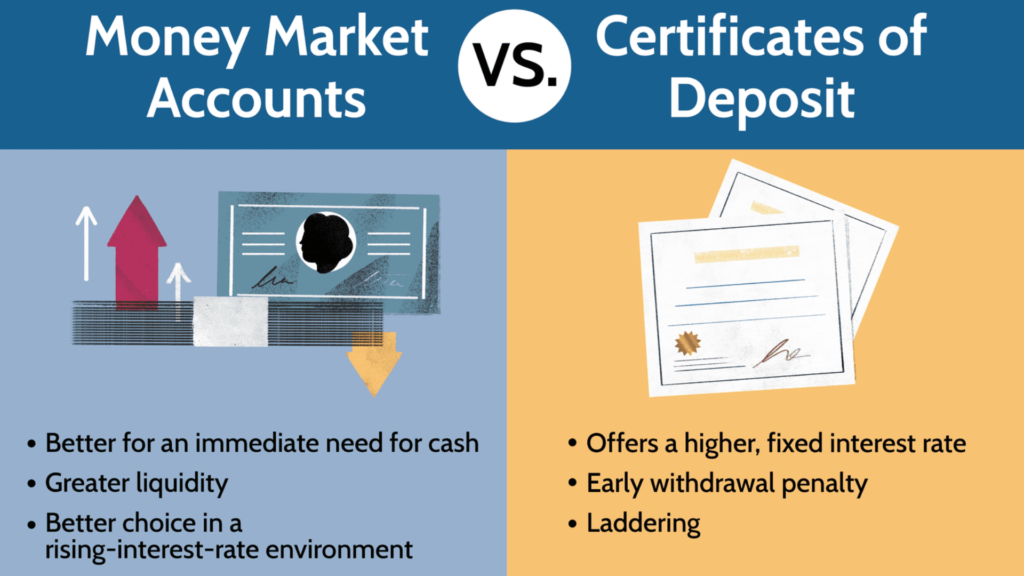

How Are Certificates of Deposits Different From Savings Accounts and Money Market Accounts?

Even though money market accounts, savings accounts, and CDs are all considered low-risk investments, they are different in some ways, like:

- Interest Rates: CDs usually offer higher interest rates than savings or money market accounts because you agree to keep your money untouched for a set period. On the other hand, savings and money market accounts offer more flexibility, allowing you to access your money at any time but usually at a lower interest rate.

- Liquidity: One significant difference is that CDs are not as liquid as other savings options. With a savings or money market account, you can withdraw your money anytime without penalties. However, CDs charge early withdrawal penalties if you withdraw your money before the term ends.

- Minimum Deposits: CDs often have a higher minimum deposit requirement than savings accounts. However, some institutions offer low or no minimum deposit CDs.

- Purpose and Use: Savings and money market accounts are ideal for emergency funds or short-term goals where you may need quick access to your money. CDs are better used for medium—to long-term goals, where the money can be left untouched to earn a higher return.

Why a Certificate of Deposit Calculator Is a Must-Have Tool

A Certificate of Deposit calculator is valuable for anyone looking to maximize their savings through CDs. It can help you choose the best CDs for your needs and guide your decision-making process, regardless of whether you’re a conservative investor looking for safe returns or have a specific financial objective.

In today’s financial space, using the CD calculator and being informed about the best CD rates and the differences between CDs, savings accounts, and money market accounts ensures you make the most of your money.

So, before locking your money into a CD, take advantage of the resources available and use a Certificate of Deposit calculator to see how much your investment can grow.